Posts on the Topic Credit

Invoice financing in Nigeria is rapidly growing, offering SMEs and contractors flexible cash flow solutions through digital platforms and tailored products amid tight credit conditions. This trend benefits businesses with reliable customers by enabling faster growth, improved supplier relationships, and...

An invoice factoring agreement is essential for establishing clear terms, minimizing risks, and fostering trust between businesses and factoring companies. Key components include fee structures, reserve policies, credit approval processes, and dispute resolution mechanisms to ensure transparency and avoid common...

Debt factoring involves various costs, including discount fees, advance rate deductions, administrative charges, penalty fees for late payments, and potential hidden expenses like setup or credit check fees. Understanding the fee structures—tiered rates, flat agreements, recourse vs. non-recourse options—and additional...

Invoice finance auditors ensure financial accuracy, compliance, and transparency by validating invoices, identifying discrepancies, and collaborating across departments. This dynamic role offers growth opportunities in various industries like banking, manufacturing, and tech for detail-oriented professionals with strong analytical skills....

Factoring companies address cash flow challenges by purchasing unpaid invoices, providing immediate liquidity to businesses across various industries. Their growth stems from evolving services like credit checks and payment collection, making them vital financial partners for SMEs and larger corporations...

Invoice financing in Vietnam is revolutionizing cash flow for SMEs by converting pending invoices into immediate funds, enhancing liquidity and enabling growth without the need for collateral. With streamlined digital processes and competitive terms, Vietnamese businesses can access quick financial...

Debt factoring, or invoice factoring, allows businesses to sell their accounts receivable for immediate cash flow, aiding in liquidity improvement, business expansion support, and credit risk management. This financial tool helps companies meet short-term obligations, invest in growth opportunities, manage...

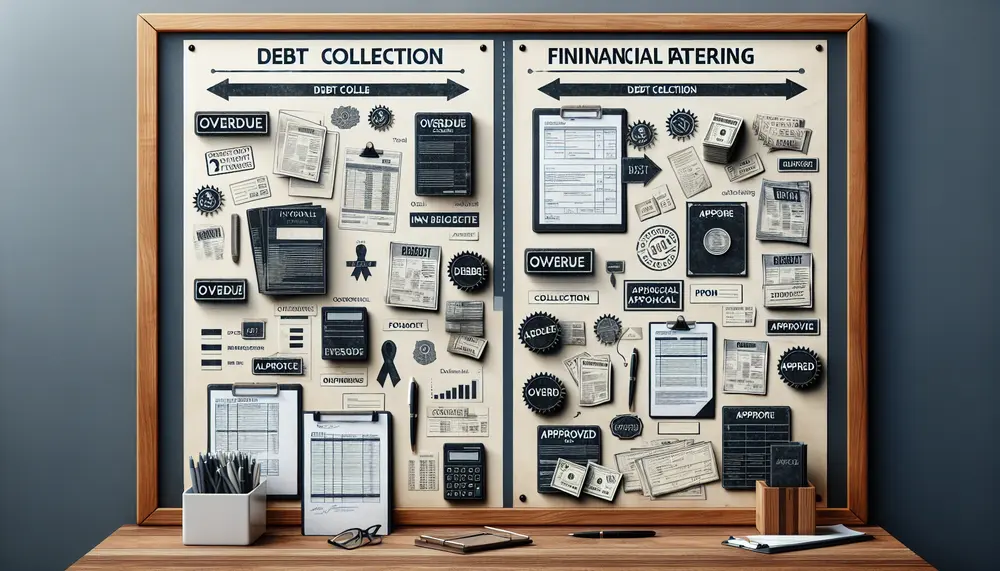

The article explains the differences between debt collection and factoring, highlighting that debt collection targets overdue invoices to recover funds while factoring involves selling current invoices for immediate cash flow. It discusses key distinctions such as timing, payment speed, responsibility,...

Technology is crucial for factoring banks, enhancing risk management and operational efficiency through tools like data analytics, automation, blockchain, and CRM systems. These technologies help in assessing credit risk, automating processes to reduce errors and save time, ensuring secure transactions,...

Export factoring is a financial service that helps businesses convert international invoices into immediate cash, improving liquidity and reducing the risk of non-payment from foreign buyers. Banks facilitate this process by acting as intermediaries between exporters and factoring companies, providing...