Posts on the Topic Factor

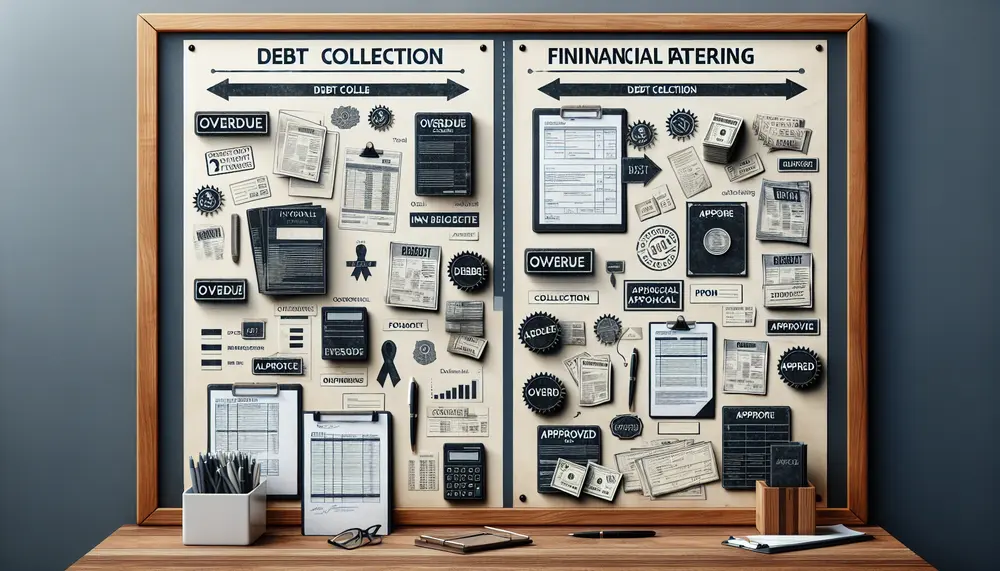

The article explains the differences between debt collection and factoring, highlighting that debt collection targets overdue invoices to recover funds while factoring involves selling current invoices for immediate cash flow. It discusses key distinctions such as timing, payment speed, responsibility,...