Posts on the Topic Invoices

Factoring agreements in Malaysia provide businesses, especially SMEs, with immediate liquidity by selling receivables, offering tailored solutions like Islamic factoring and reducing cash flow challenges. These agreements streamline operations through defined steps such as invoice selection, advance payments, and customer...

Debt factoring involves various costs, including discount fees, advance rate deductions, administrative charges, penalty fees for late payments, and potential hidden expenses like setup or credit check fees. Understanding the fee structures—tiered rates, flat agreements, recourse vs. non-recourse options—and additional...

A factoring company account provides businesses with immediate cash flow by converting invoices into working capital, offering benefits like credit management, scalability, and reduced financial stress. It enhances operational efficiency, supports growth, and ensures predictable finances without adding debt to...

Factoring companies in Australia provide tailored financial solutions, such as invoice factoring and debtor management, to help businesses maintain cash flow and reduce risks. They cater to diverse industries like manufacturing, logistics, and construction while leveraging technology for efficiency and...

Factoring companies address cash flow challenges by purchasing unpaid invoices, providing immediate liquidity to businesses across various industries. Their growth stems from evolving services like credit checks and payment collection, making them vital financial partners for SMEs and larger corporations...

Debt factoring provides businesses with immediate cash flow by selling outstanding invoices, reducing financial risks and administrative burdens while enhancing operational liquidity. It offers a flexible alternative to traditional financing but requires careful consideration of costs and potential challenges like...

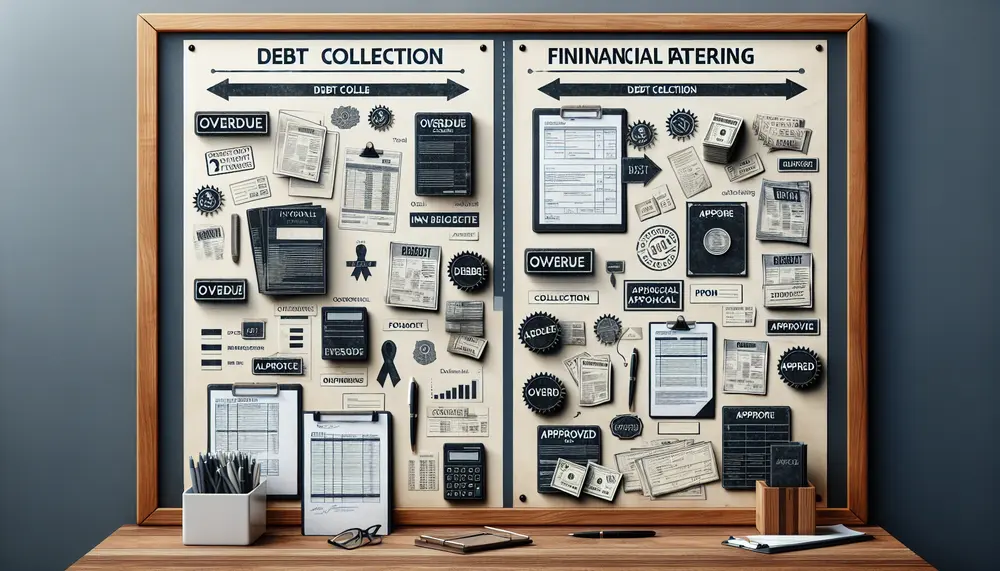

The article explains the differences between debt collection and factoring, highlighting that debt collection targets overdue invoices to recover funds while factoring involves selling current invoices for immediate cash flow. It discusses key distinctions such as timing, payment speed, responsibility,...